Understanding “Contoh Desain Business Plan” (Example Business Plan Designs)

Contoh desain business plan – A well-structured business plan is crucial for the success of any Indonesian venture, whether a small-scale operation or a large corporation. It serves as a roadmap, guiding decision-making and attracting potential investors. Understanding the components and adapting the plan to the specific needs of your business is key.

Core Components of an Indonesian Business Plan

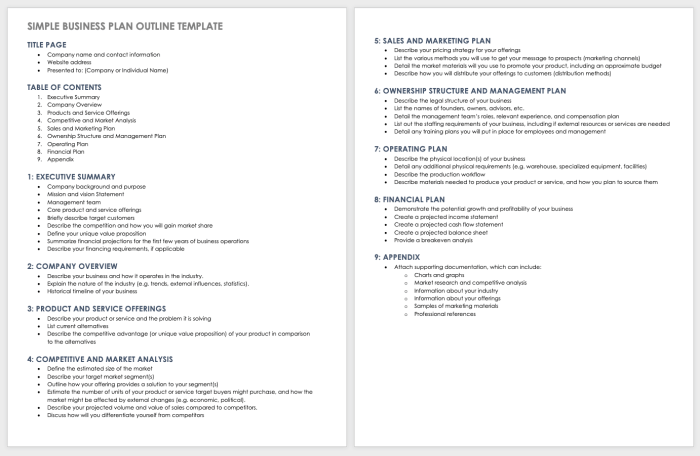

A typical Indonesian business plan, while adhering to general business planning principles, often reflects the local context. This includes considerations specific to the Indonesian regulatory environment, market dynamics, and cultural nuances. Key components typically include an executive summary, company description, market analysis, organization and management, service or product line, marketing and sales strategy, funding request (if applicable), and financial projections.

The emphasis on certain sections may vary depending on the stage of the business and the intended audience. For example, a startup will place greater emphasis on its market analysis and funding request, while an established business might focus more on its financial projections and expansion strategies.

Differences Between Business Plans for Startups Versus Established Businesses

Startups and established businesses require different approaches to business planning. Startups typically focus on securing funding and demonstrating market viability. Their business plans emphasize market research, a clear value proposition, and a detailed financial model projecting profitability within a specific timeframe. Established businesses, on the other hand, often use business plans for internal strategic planning, expansion into new markets, or seeking additional investment.

Their plans will likely focus on operational efficiency, market share growth, and diversification strategies, with a more established financial history to draw upon. A startup’s plan is more about proving potential, while an established business’s plan demonstrates track record and future trajectory.

Examples of Different Business Plan Formats and Their Suitability

Several formats exist for business plans, each suited to different industries and contexts. A traditional business plan is comprehensive and detailed, ideal for securing significant funding or for complex ventures. A lean startup business plan is concise and iterative, focusing on key assumptions and testing them rapidly. A one-page business plan is extremely brief, suitable for initial exploration or internal use.

So, you’re crafting a killer business plan, right? Thinking about the big picture, like your target market and all that? Well, consider the aesthetics too; even a solid business plan needs a good visual. For inspiration, check out the awesome bus designs from overseas – seriously, the creativity is insane! Check out these contoh desain bus diluar negeri terbaru for some fresh ideas.

That same creative energy can totally boost your business plan presentation, making it pop and stand out.

The choice depends on the complexity of the business, the audience, and the stage of development. For instance, a tech startup might utilize a lean startup plan to quickly test its core assumptions, while a manufacturing company seeking a bank loan might need a more traditional, comprehensive plan.

Comparison of Business Plan Templates, Contoh desain business plan

| Template | Strengths | Weaknesses | Best Suited For |

|---|---|---|---|

| Traditional Business Plan | Comprehensive, detailed, suitable for securing significant funding | Time-consuming to create, may be overwhelming for simple businesses | Large businesses, seeking substantial investment, complex ventures |

| Lean Startup Business Plan | Iterative, adaptable, focuses on key assumptions | May lack detail for some investors, requires a strong understanding of the methodology | Tech startups, businesses with rapidly changing environments |

| One-Page Business Plan | Concise, easy to understand, good for initial exploration | Lacks depth, unsuitable for securing large investments | Internal planning, initial concept development, quick pitches |

Key Sections of a Business Plan

A well-structured business plan is crucial for securing funding, guiding operations, and achieving long-term success. It acts as a roadmap, outlining your goals, strategies, and financial projections. Each section plays a vital role in presenting a compelling narrative of your business’s potential. Let’s explore the key components.

Executive Summary

The executive summary is the most important section of your business plan. It provides a concise overview of your entire plan, highlighting key aspects such as your business concept, target market, competitive advantages, and financial projections. Think of it as your elevator pitch, designed to capture the reader’s attention and leave a lasting impression. A compelling executive summary should be clear, concise, and persuasive, summarizing the key elements of your business plan in a way that immediately showcases its viability and potential for success.

It should be written last, after all other sections are complete, to ensure accuracy and coherence.

Market Analysis

A thorough market analysis demonstrates your understanding of the industry landscape and your target market. This section should include:

- Market Size and Trends: Describe the overall size of your target market, its growth potential, and any relevant trends influencing the industry. For example, in the Indonesian coffee market, you might cite data on increasing coffee consumption and the growing popularity of specialty coffee shops.

- Target Customer Profile: Define your ideal customer, including demographics, psychographics, and purchasing behavior. For a coffee shop, this might involve specifying age ranges, income levels, lifestyle preferences, and coffee consumption habits.

- Competitor Analysis: Identify your main competitors, analyze their strengths and weaknesses, and Artikel your competitive advantages. This might involve comparing your coffee shop’s offerings, pricing, and location to those of established competitors in the area. For example, you could highlight a unique coffee blend, a superior atmosphere, or a more convenient location.

- Market Segmentation: Divide your target market into distinct segments based on shared characteristics. This allows for more targeted marketing efforts and a better understanding of diverse customer needs within your overall market. For example, you might segment your customer base by age (students, young professionals, families) or by preference (espresso drinkers, latte lovers, iced coffee enthusiasts).

Company Description

This section details your business’s mission, vision, and organizational structure. It should clearly articulate what your business does, how it does it, and what makes it unique.

Example: Indonesian Coffee Shop – “Kopi Nusantara”

Kopi Nusantara is a specialty coffee shop located in [City, Indonesia] dedicated to showcasing the rich diversity of Indonesian coffee beans. Our mission is to provide a welcoming and authentic coffee experience, highlighting the unique flavors and origins of Indonesian coffee. We source our beans directly from local farmers, ensuring fair prices and supporting sustainable farming practices. Our vision is to become a leading destination for coffee lovers in [City], known for our exceptional quality, friendly atmosphere, and commitment to community.

The company is structured as a [Sole Proprietorship/Partnership/LLC], with [Owner Name(s)] as the managing partner(s).

Financial Projections

This section is critical for demonstrating the financial viability of your business. It should include realistic projections for at least three years, covering key aspects such as startup costs, revenue projections, and profitability analysis. Remember to use conservative estimates and justify your assumptions.

Financial projections should be presented clearly and transparently, allowing potential investors or lenders to easily assess the financial health and potential of your business. Consider using charts and graphs to visually represent your projections and make them more easily digestible. Accurate and well-supported financial projections are essential for securing funding and building confidence in your business’s long-term sustainability.

- Startup Costs:

- Leasehold improvements: Rp 50,000,000

- Equipment (espresso machine, grinder, etc.): Rp 30,000,000

- Initial inventory: Rp 10,000,000

- Marketing and advertising: Rp 5,000,000

- Licenses and permits: Rp 2,000,000

- Total Startup Costs: Rp 97,000,000

- Revenue Projections: Based on estimated sales volume and average transaction value, project annual revenue for the next three years. For example: Year 1: Rp 200,000,000; Year 2: Rp 300,000,000; Year 3: Rp 400,000,000. These figures should be supported by market research and realistic assumptions about customer traffic and pricing.

- Profitability Analysis: Calculate projected profit margins, net income, and return on investment (ROI) for each year. This will show your potential for profitability and demonstrate the financial return for investors. Consider using standard profitability ratios such as Gross Profit Margin and Net Profit Margin. For example: Year 1 Net Profit Margin: 10%; Year 2: 15%; Year 3: 20%.

Funding and Financial Resources

Securing adequate funding is a crucial step in establishing and growing a business in Indonesia. Understanding the various funding options available and crafting a robust financial plan are essential for attracting investors and ensuring long-term financial stability. This section will explore different funding avenues and the importance of a well-structured financial plan in securing those funds.

Funding Options in Indonesia

Several avenues exist for Indonesian businesses seeking funding. These range from traditional bank loans to attracting private investors or exploring government-backed initiatives. Each option has its own set of requirements and implications, demanding careful consideration based on the specific needs and characteristics of the business.

- Bank Loans: Traditional bank loans are a common source of funding. Securing a loan typically involves presenting a detailed business plan, demonstrating financial stability and a viable repayment strategy. Interest rates and loan terms vary depending on the bank and the borrower’s creditworthiness.

- Venture Capital and Angel Investors: Venture capitalists and angel investors provide funding in exchange for equity in the company. This option is often pursued by businesses with high growth potential but requires a compelling business plan showcasing significant market opportunity and a strong management team.

- Government Grants and Subsidies: The Indonesian government offers various grants and subsidies to support small and medium-sized enterprises (SMEs). These programs often target specific industries or regions and usually come with eligibility criteria that businesses need to meet.

- Crowdfunding: Crowdfunding platforms allow businesses to raise capital from a large number of individuals through online platforms. This approach relies heavily on effective marketing and a strong online presence to attract potential investors.

Importance of a Well-Defined Financial Plan

A well-defined financial plan is not merely a formality; it’s the cornerstone of securing funding. It demonstrates your understanding of the business’s financial health, potential, and risk factors. Investors and lenders rely on this plan to assess the viability of your business and the likelihood of a successful return on investment. A comprehensive financial plan instills confidence and reduces uncertainty for potential funders.

Financial Statements in a Business Plan

A comprehensive business plan typically includes several key financial statements. These statements provide a clear picture of the business’s past performance, current financial position, and future projections.

- Income Statement: This statement shows the revenue, expenses, and profit or loss of the business over a specific period. It illustrates the business’s profitability and operational efficiency.

- Balance Sheet: This statement presents a snapshot of the business’s assets, liabilities, and equity at a specific point in time. It reflects the financial health and solvency of the business.

- Cash Flow Statement: This statement tracks the movement of cash in and out of the business. It provides insights into the business’s liquidity and ability to meet its short-term obligations.

Key Financial Ratios and Their Significance

Analyzing key financial ratios helps assess the business’s financial viability and performance. These ratios provide valuable insights into profitability, liquidity, and solvency.

- Profit Margin: This ratio indicates the percentage of revenue that translates into profit. It is calculated as Net Profit / Revenue. A higher profit margin suggests better operational efficiency and pricing strategies.

- Current Ratio: This ratio measures the business’s ability to meet its short-term obligations. It is calculated as Current Assets / Current Liabilities. A ratio greater than 1 indicates sufficient liquidity.

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt financing relative to equity financing. It is calculated as Total Debt / Total Equity. A high ratio suggests higher financial risk.

For example, a company with a high profit margin and a healthy current ratio would be considered more financially sound and attractive to potential investors compared to a company with low profit margins and a low current ratio. These ratios, when analyzed alongside other financial statements and market data, provide a holistic view of the business’s financial health.

Legal and Regulatory Considerations

Starting a business in Indonesia involves navigating a complex legal and regulatory landscape. Understanding these requirements is crucial for ensuring your business operates legally and avoids potential penalties or disruptions. This section Artikels key legal considerations and the registration process, providing a framework for navigating Indonesian business law.

Key Legal and Regulatory Requirements in Indonesia

Establishing a business in Indonesia requires adherence to various laws and regulations at both national and local levels. These regulations cover aspects such as business registration, taxation, labor laws, environmental protection, and intellectual property rights. Failure to comply with these regulations can lead to significant legal and financial consequences. For example, operating without the necessary permits can result in fines, business closure, and even criminal charges.

Understanding these requirements is paramount for long-term business sustainability and success.

Business Registration Process in Indonesia

The process of registering a business in Indonesia varies depending on the type of business entity chosen. Common business structures include Perusahaan Terbatas (PT) – a limited liability company, and CV (Commanditaire Vennootschap) – a limited partnership. Registration typically involves submitting documents to the Agency for the Assessment and Application of Technology (BPPT), the Ministry of Law and Human Rights, and local government agencies.

The process often requires navigating bureaucratic procedures and fulfilling specific documentation requirements, which can be time-consuming. Seeking assistance from a legal professional experienced in Indonesian business law is highly recommended to streamline this process and ensure compliance. This professional can help navigate the complexities of the registration process and ensure all necessary documents are correctly filed.

Importance of Obtaining Necessary Licenses and Permits

Securing the appropriate licenses and permits is essential for legal operation. These licenses and permits vary depending on the nature of the business and its location. For example, a restaurant will need a food handling license, while a manufacturing company may require environmental permits. Operating without the necessary licenses can result in hefty fines and legal repercussions.

Proactive acquisition of all required permits demonstrates compliance and minimizes the risk of future legal issues. It is important to thoroughly research and understand the specific licenses and permits required for your chosen business type and location.

Common Legal Issues Faced by Businesses in Indonesia

Businesses in Indonesia may encounter various legal challenges, including issues related to contract law, intellectual property rights, labor disputes, and tax compliance. Contract disputes can arise from poorly drafted agreements or disagreements over contractual obligations. Protecting intellectual property rights requires careful registration and enforcement. Labor disputes may stem from disagreements over wages, working conditions, or termination of employment.

Maintaining accurate tax records and complying with tax regulations is crucial to avoid penalties. Seeking legal counsel can help mitigate these risks and ensure compliance with Indonesian law. For example, a thorough review of contracts by a legal professional can prevent future disputes. Similarly, proactive registration of intellectual property rights protects your business from infringement.

FAQ Resource: Contoh Desain Business Plan

What are the common pitfalls to avoid when creating a business plan in Indonesia?

Underestimating bureaucratic hurdles, neglecting cultural nuances in marketing, failing to account for inflation and currency fluctuations, and overlooking potential legal and regulatory changes.

How important is local partnership in navigating the Indonesian business environment?

Crucial. Local partners provide invaluable insights into navigating regulations, understanding cultural sensitivities, and accessing local networks.

What are some common funding sources beyond traditional bank loans?

Venture capital, angel investors, government grants, and crowdfunding platforms are increasingly prevalent options.